Learn what a Waiver of the Statute of Limitations is, how it affects debt repayment in Korea, and why a 2025 Supreme Court ruling just changed the game for debtors.

In Korean civil law, the concept of Waiver of the Statute of Limitations plays a crucial role in how old debts are treated. When a debt is past its statutory deadline (usually several years of inactivity), the debtor gains the right to refuse payment. This right is called the benefit of the statute of limitations, or 시효이익 in Korean. But what happens when someone repays a debt even after this period has expired?

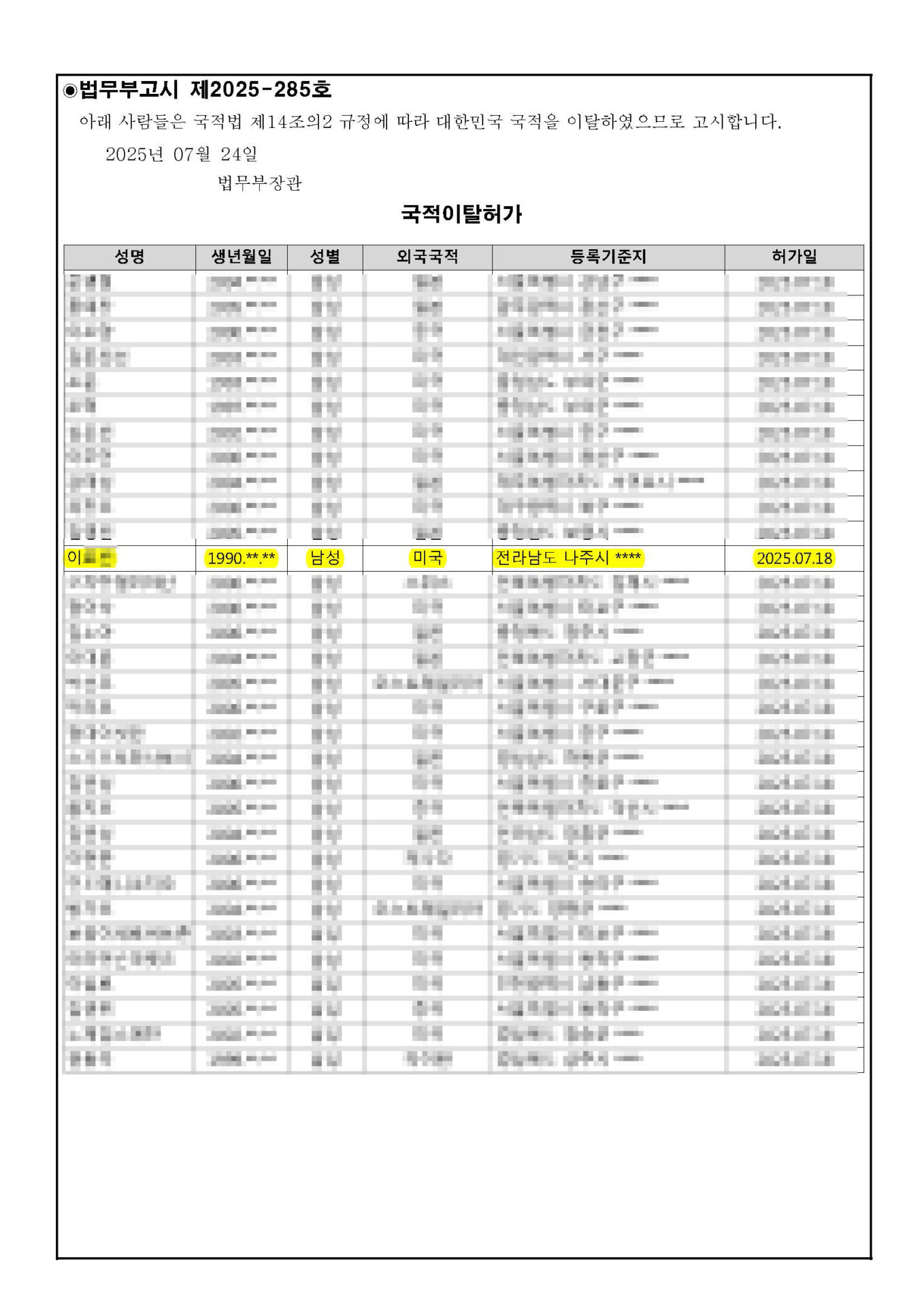

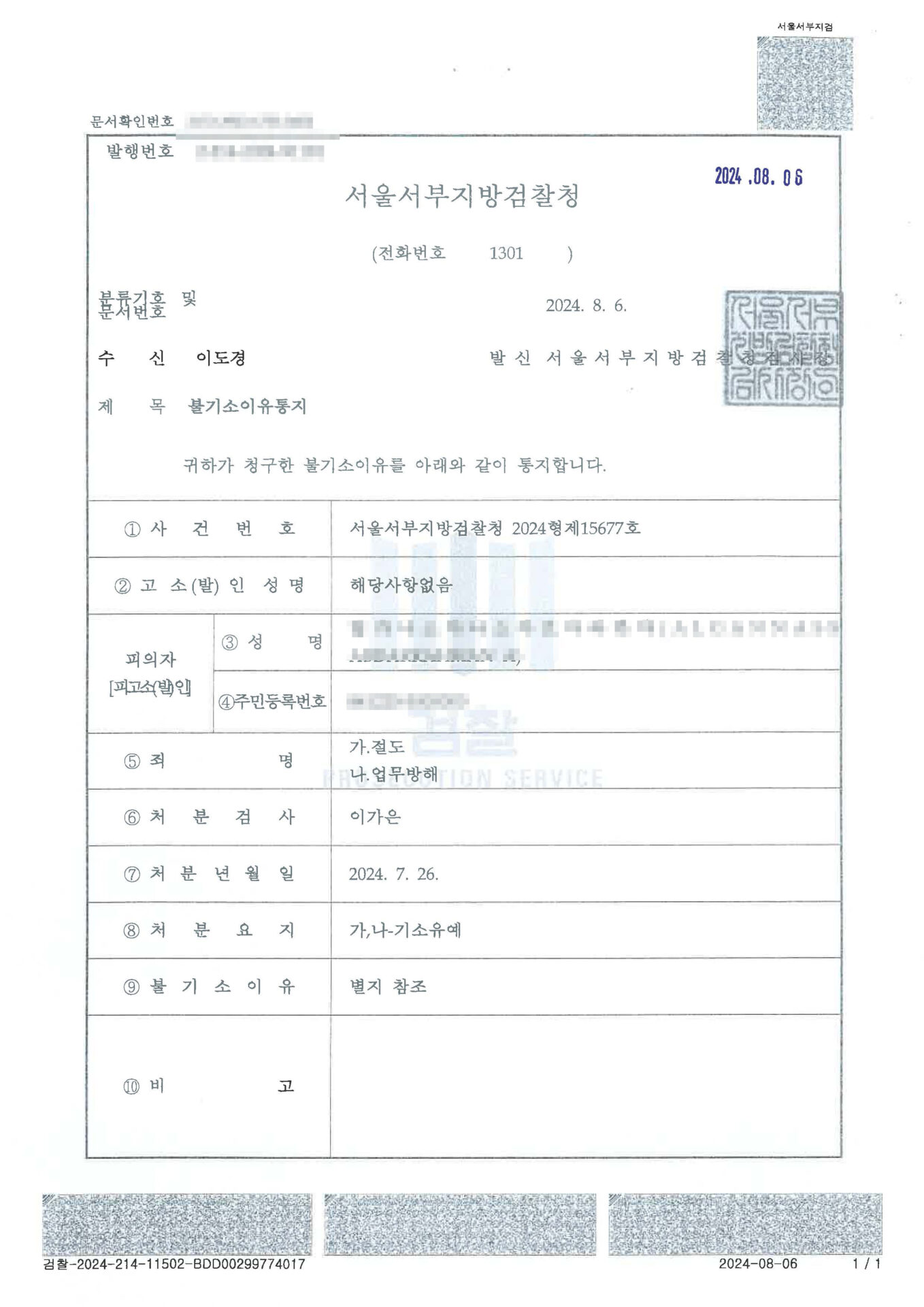

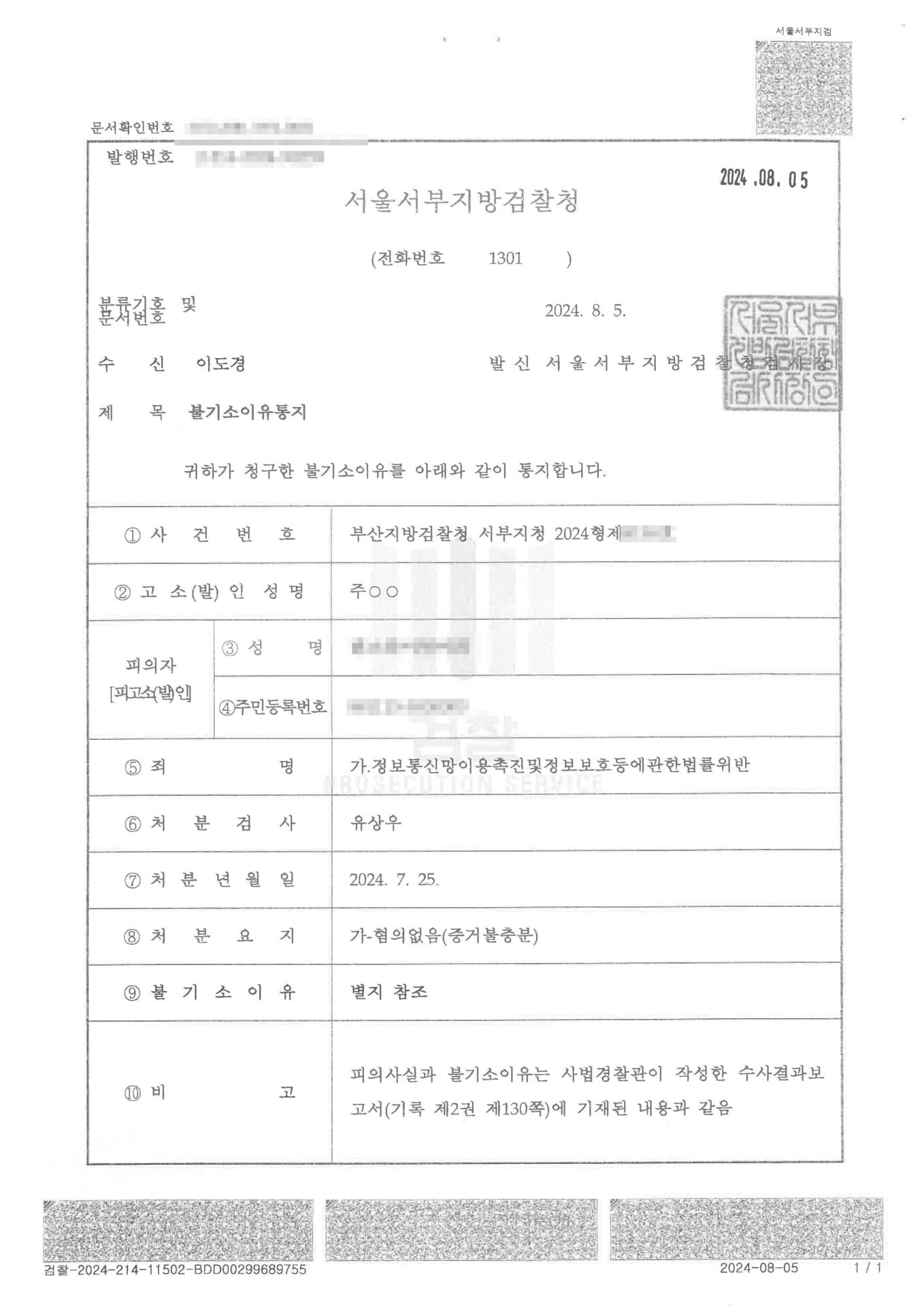

Until recently, Korean courts had assumed that such repayment meant the debtor waived that right. However, a groundbreaking decision by the Korean Supreme Court on July 24, 2025 changed that legal presumption.

What Is the Waiver of the Statute of Limitations?

A Waiver of the Statute of Limitations occurs when a debtor knowingly gives up their right to reject payment of a time-barred debt. Under previous precedent, if someone made any payment after the statute of limitations expired, it was automatically presumed they waived their right. This legal shortcut often placed debtors at a serious disadvantage.

The new Supreme Court ruling overturns that assumption.

The 2025 Supreme Court Decision: A Shift Toward Fairness

In the case at issue, a fisherman named Mr. A had borrowed 240 million KRW. By the time he repaid 18 million KRW in interest, part of the debt had already expired under the statute of limitations. Later, during foreclosure proceedings, the creditor claimed full repayment—interest included.

Lower courts ruled that Mr. A had waived the statute of limitations simply because he paid part of the debt. But the Supreme Court said that’s not enough.

Instead, courts must now examine whether the debtor understood that the debt was time-barred and still chose to repay it. Intent must be proven, not presumed.

Why This Matters for Debtors

This ruling re-centers fairness in debt disputes. The Waiver of the Statute of Limitations is no longer automatic. It must be clear and intentional.

This protects individuals who may:

- Repay out of confusion or pressure

- Be unaware that the debt was no longer legally enforceable

- Act without legal advice

By demanding proof of intent, the Court aims to create a more balanced legal process and reduce unjust financial burdens.

Practical Implications

If you’ve made payments on an expired debt, you may still retain your statutory protections—depending on your intent and awareness. Collectors can no longer use partial repayment as a blanket justification to demand more.

If you’re facing a similar issue or unsure about your situation, you should speak with a legal professional to evaluate your options.

Let us help.

At Pureum Law Office, we guide our clients with clarity, integrity, and compassion. If you’ve repaid an expired debt or are dealing with a creditor, don’t guess—email us at ask@pureumlawoffice.com and get answers you can trust.