Understanding Foreigner Real Estate Law is essential for anyone looking to invest in property outside their home country. Whether you’re a Korean citizen buying property in the U.S., or a U.S. citizen purchasing real estate in Korea, cross-border ownership is possible—but not without legal complexity.

From ownership restrictions to tax reporting, this article explains how Foreigner Real Estate Law applies in key jurisdictions like Korea and the United States.

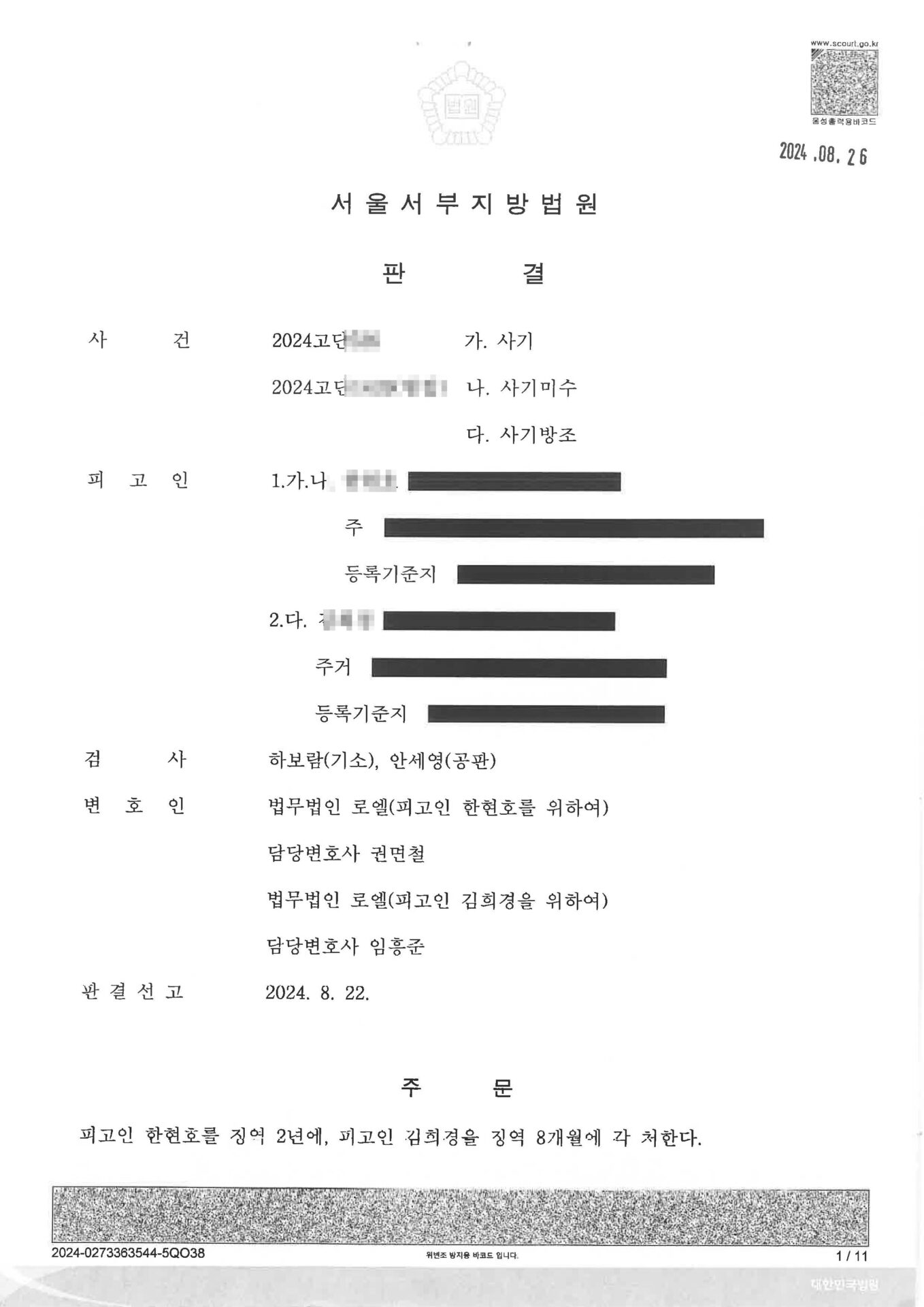

Can Foreigners Own Property in Korea?

Yes, under the Foreigner’s Land Acquisition Act and Registration of Real Estate Act, foreigners can purchase real estate in South Korea. However, there are steps and limitations:

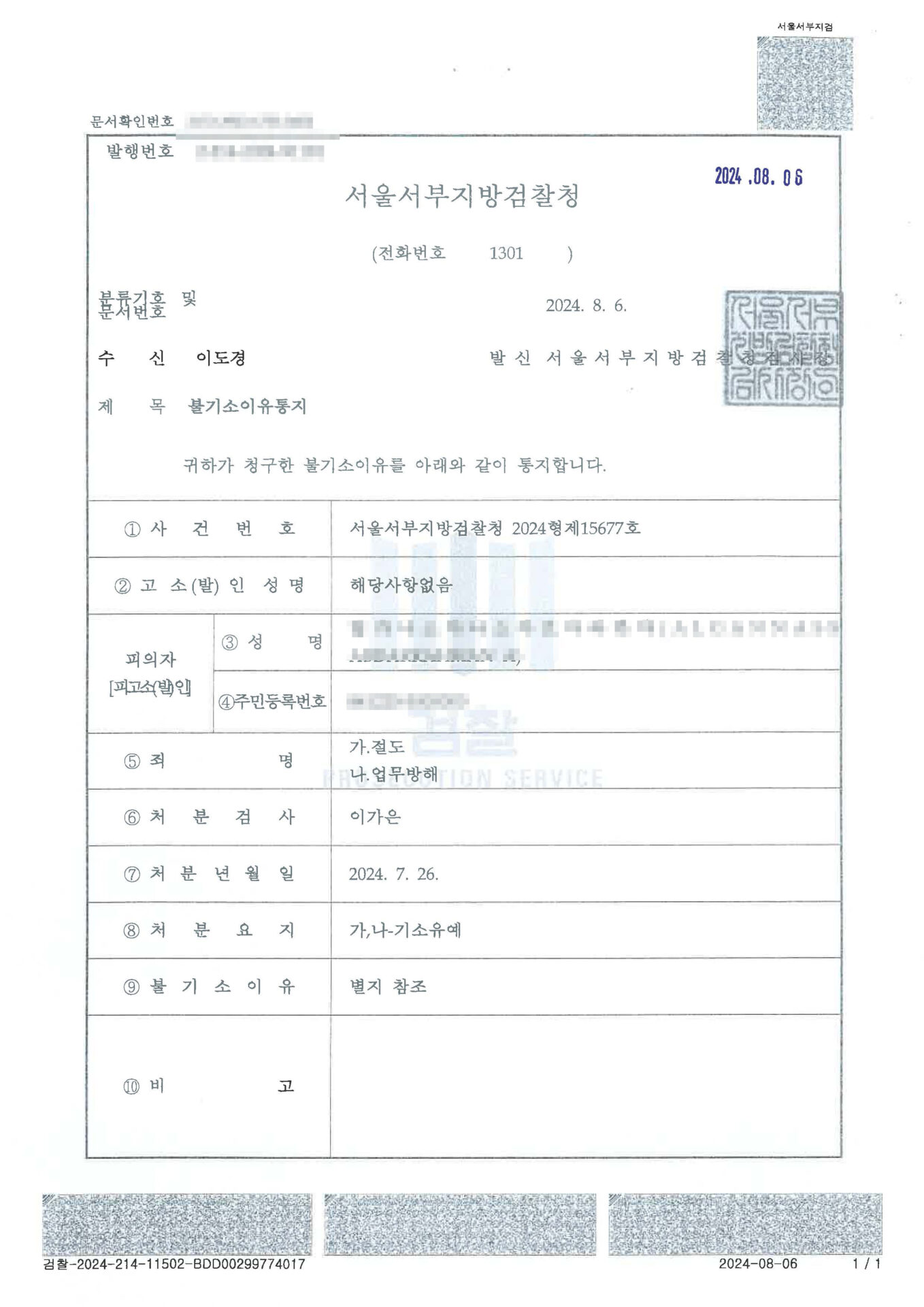

- Foreigners must report land acquisition to the local government office within 60 days of signing a contract. If a foreign national fails to report the acquisition of real estate in Korea, it may become impossible to remit the proceeds abroad when the property is later sold. In such cases, a violation report and post-acquisition filing must be submitted, and the Financial Supervisory Service (FSS) may impose an administrative fine.

- Property near military installations or cultural heritage zones may require additional clearance.

- Title registration must be completed in Korean and filed correctly with legal identifiers.

If you’re a U.S. citizen or other foreign national, a Korean real estate lawyer can help ensure all procedures are lawfully handled.

🔗 Korea Ministry of Land, Infrastructure and Transport (DoFollow)

How About Foreigners Buying U.S. Real Estate?

There are no citizenship requirements to purchase property in the U.S. That said, Foreigner Real Estate Law touches on these key areas:

- Financing: Foreigners may face stricter mortgage terms or need to provide higher down payments.

- Taxation: Foreign investors are subject to the Foreign Investment in Real Property Tax Act (FIRPTA).

- Estate Tax: Upon death, non-resident aliens may be subject to steep U.S. estate taxes.

Having a real estate attorney familiar with Foreigner Real Estate Law is vital, especially when dealing with FIRPTA or IRS Form 8288 for withholding.

Common Legal Pitfalls in Foreigner Real Estate Law

Not Reporting the Transaction Properly

Failing to register or disclose a transaction can lead to fines, delays, or even a void sale.

Misunderstanding Local Zoning Laws

Just because property is for sale doesn’t mean it’s legally usable for your purpose. Foreign buyers must consult with local land-use attorneys.

Incorrect Visa Assumptions

Buying property does not guarantee a visa or residency. This is one of the most misunderstood aspects of Foreigner Real Estate Law.

Let Us Help

Navigating Foreigner Real Estate Law requires more than enthusiasm—it demands precision, documentation, and experienced legal guidance. At Pureum Law Office, we help clients purchase and protect overseas properties with confidence.

📧 Questions? Reach out today at ask@pureumlawoffice.com — and let us help.